Insider Insights on Navigating Offshore Company Formation Efficiently

Starting the trip of establishing an offshore company is a calculated decision that requires meticulous preparation and implementation. The intricacies associated with navigating the intricacies of offshore business development can be discouraging for even experienced entrepreneurs. Nonetheless, getting expert understandings from experts that have actually successfully steered with the process can give invaluable advice and an affordable edge in this arena. As we dig into the nuances of choosing the best jurisdiction, understanding legal demands, handling tax ramifications, developing banking relationships, and making certain conformity, a wide range of knowledge waits for those looking for to understand the art of offshore firm development.

Choosing the Right Jurisdiction

When considering overseas business development, choosing the suitable jurisdiction is an essential decision that can dramatically affect the success and operations of the service. Each jurisdiction uses its very own collection of legal structures, tax regulations, privacy regulations, and monetary rewards that can either benefit or impede a business's purposes. It is important to conduct complete research and seek specialist advice to ensure the chosen jurisdiction aligns with the business's requirements and objectives.

Aspects to take into consideration when choosing a territory consist of the political and financial security of the area, the ease of working, the degree of monetary privacy and confidentiality provided, the tax ramifications, and the regulatory atmosphere. Some jurisdictions are known for their desirable tax structures, while others prioritize privacy and possession defense. Comprehending the distinct attributes of each territory is critical in making an informed decision that will support the long-term success of the offshore company.

Ultimately, selecting the best jurisdiction is a calculated relocation that can give possibilities for development, asset protection, and operational effectiveness for the overseas firm.

Comprehending Lawful Requirements

To make sure compliance and authenticity in offshore firm development, an extensive understanding of the lawful requirements is crucial. Different territories have varying lawful frameworks governing the establishment and operation of overseas business. Remaining informed and up to day with the lawful landscape is vital for effectively navigating offshore business formation and making sure the long-lasting sustainability of the business entity.

Browsing Tax Obligation Effects

Understanding the intricate tax obligation ramifications linked with overseas firm formation is crucial for guaranteeing compliance and maximizing monetary techniques. Offshore firms commonly provide tax obligation advantages, however navigating the tax obligation landscape needs extensive knowledge and appropriate planning. One key consideration is the principle of tax residency, as it figures out the territory in which the firm is exhausted. It's vital to understand the tax obligation legislations of both the overseas territory and the home nation to avoid dual taxation or unexpected tax obligation repercussions.

In addition, transfer prices regulations need to be carefully reviewed to guarantee transactions between the overseas entity and associated parties are conducted at arm's length to stay clear of tax evasion accusations. Some territories provide tax incentives for specific markets or activities, so understanding these rewards can assist make best use of tax savings.

Additionally, staying up to date with evolving global tax obligation policies and compliance needs is vital to avoid charges and maintain the business's online reputation. Looking for professional guidance from tax obligation professionals or specialists with experience in offshore tax obligation issues can give valuable understandings and make sure a smooth tax obligation planning process for the overseas business.

Establishing Financial Relationships

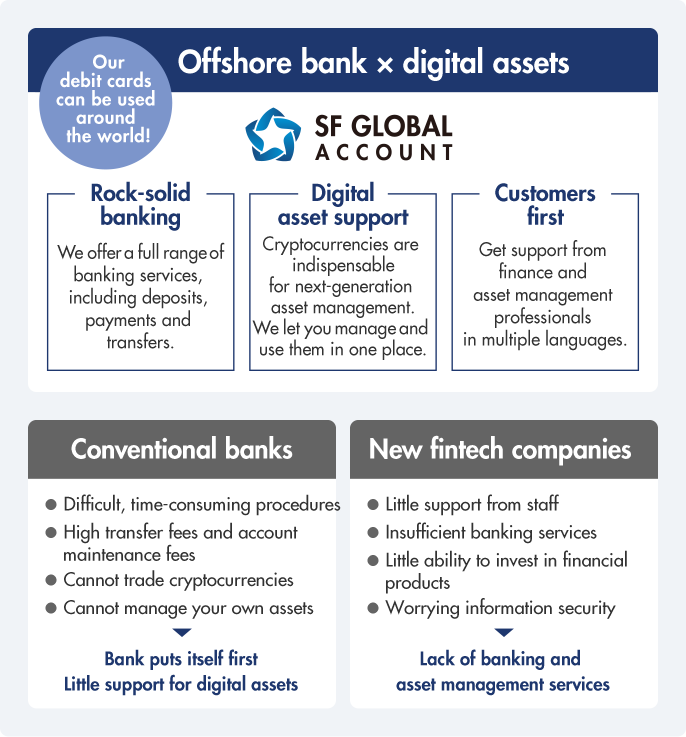

Establishing secure and reputable banking partnerships is a crucial step in the procedure of offshore firm development. When establishing up banking connections for an overseas company, it is vital to choose trustworthy monetary organizations that supply services tailored to the particular demands of global services.

In addition, prior to opening a savings account for an overseas firm, detailed due diligence treatments are generally required to validate the legitimacy of the company and its stakeholders. This may involve providing in-depth paperwork regarding the business's tasks, resource of funds, and valuable owners. Developing a cooperative and transparent connection with the picked financial institution is crucial to browsing the complexities of offshore financial effectively.

Ensuring Compliance and Reporting

After establishing safe and secure financial relationships for an offshore company, the following vital action is ensuring compliance and reporting procedures are meticulously complied with. Compliance with international regulations and neighborhood regulations is extremely important to keep the authenticity and track record of the overseas entity. This includes adhering to anti-money laundering (AML) and understand your client (KYC) requirements. Regular reporting obligations, such as financial declarations and tax filings, need to be fulfilled to remain in great standing with regulative authorities. Engaging economic and legal experts with know-how in overseas jurisdictions can help navigate the complexities of conformity and reporting.

Failure to comply with regulations can result in serious penalties, fines, and even the abrogation of the overseas firm's certificate. Consequently, remaining attentive and positive in making certain compliance and reporting requirements is essential for the long-lasting success of an overseas entity.

Final Thought

In conclusion, successfully browsing offshore business development calls for cautious consideration of the jurisdiction, lawful demands, tax obligation ramifications, banking connections, compliance, and reporting. By comprehending these key aspects and guaranteeing adherence to regulations, companies can develop a solid structure for their overseas procedures. It is critical to seek expert guidance and expertise to navigate the intricacies of offshore business development efficiently.

As we delve right into the subtleties of selecting the right browse around this site jurisdiction, comprehending lawful requirements, handling tax obligation ramifications, establishing banking partnerships, and making certain compliance, a riches of understanding waits for those looking for to understand the art of overseas company formation.

When taking into consideration overseas Find Out More firm development, picking the proper territory is a critical choice that can significantly impact the success and procedures of the organization.Understanding the intricate tax ramifications associated with overseas firm development is important for making sure conformity and optimizing economic strategies. Offshore firms often supply tax obligation advantages, but navigating the tax obligation landscape needs comprehensive expertise and correct preparation.In verdict, efficiently navigating offshore company development calls for careful consideration of the territory, lawful needs, tax ramifications, banking relationships, conformity, and coverage.